Xero Update – Saving Files and Eliminating Paper

As you all know I am a big supporter of the online accounting program Xero (www.xero.com.au) due to its simplicity of use, ability to access from any location, no data backups required, etc. Most importantly I can work with you in a more timely manner by being able to view the same data and information you are looking at.

Over the past month Xero have simplified the process by which you can now save documents into the system by simply dragging and dropping the document when you are entering the invoice or expense.

By using Xero to store your documents it saves you having to file records in cabinets or boxes freeing up valuable space.

How do I save documents?

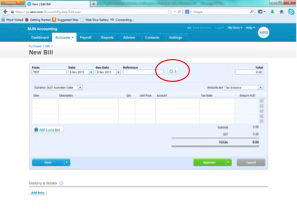

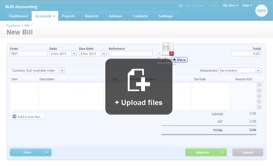

Easy! Xero now allows you to drag and drop your files into Xero as you are entering the information. I have attached 2 screen shots to show you how it works.

Xero have added an icon which I have circled in Red.

All you need to do is to drag the pdf file over this icon and the following “+ Upload Files” appear, then release your file and it will be saved into Xero … what could be simpler!?

Is it safe?

Xero maintains its data in secure locations. I trust Xero and save all my accounting paperwork in Xero and don’t maintain paper or other copies outside of Xero.

Can I view or reprint them later?

Yes they can be easily viewed or downloaded at any time in the future.

ATO’s view of Electronic (Scanned) Records

Many people ask me, “Am I required to keep the original paperwork?” The ATO doesn’t require you to keep originals. Thermal receipts fade and many invoices you receive come via email. The following information is directly from the ATO -

Documents that you are required to keep can be in written or electronic form. If you make paper or electronic copies they must be a true and clear reproduction of the original.

We recommend that if you store your records electronically you make a backup copy to ensure the evidence is easily accessible if the original becomes inaccessible or unreadable – for example, where a hard drive is corrupted.

See this information on the ATO website here

If required the documents can be easily downloaded from Xero and supplied to the ATO