Divide and Conquer 3

In this, the third article in our series ‘Divide and Conquer’, we’ll look at the next scenario: Building to live in.

If you haven’t read our first two articles, then I highly recommend that you do before diving into this one. Divide and Conquer Divide and Conquer … Tax implications of subdividing your propertyscratched the surface with some general information and basic scenarios, and Divide and Conquer – Part 2looked at building on subdivided land with the intent to rent it or with the intent to sell.

Building to live in

Who wouldn’t like to live in a home designed and built just for you? Subdividing and then building your dream home on the subdivided land can achieve just that.

Let’s say that you subdivide the property that you have lived in – i.e. your Principle Place of Residence (PPR) – with the intention of building a new home on the land and selling the house that you were living in prior to the subdivision (your PPR).

As the sold, subdivided property with the house on it, was your PPR, there was no Capital Gains Tax (CGT) on this sale (seeDivide and Conquer Divide and Conquer … Tax implications of subdividing your propertyfor more about this).

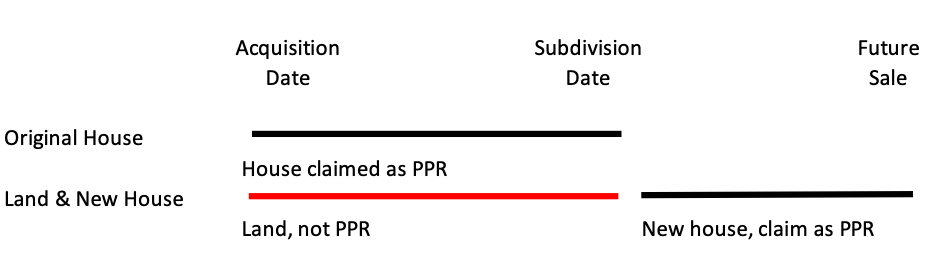

You are now left with vacant land. This vacant land is considered a separate asset and is deemed to be acquired on the date you originally purchased it, not the date of subdivision.

The following timeline demonstrates this. Remember, the date of the subdivided land backdates to the original purchase date.

As the date of acquisition of the land is the date of when it was originally purchased not when you built the house, there is a period where the property (now with a new house on it) was not your PPR. Therefore, you are only entitled to claim a partial main residence exemption for any capital gain you make when you sell the property.

Meet Lance

Lance purchased his property on 1 July 2000 for $350,000. The land and building were valued separately at $200,000 for land and $150,000 for the building. Lance has lived in the property since ownership.

On 1 July 2010 Lance subdivided the and sold the section with the original house. As he had resided in the house he claimed it as his PPR and therefore there was no CGT on the sale of this property.

Lance built his new house on the subdivided land, and it became his new PPR on 1 July 2010. The construction cost $300,000. He later sold this house and land on 1 July 2019 for $600,000.

We now have 2 time periods to consider for the house that Lance built:

- 1 July 2000 to 1 July 2010 – the un-subdivided land is ‘vacant land’ and cannot be claimed as the PPR for this period (10 years)

- 1 July 2010 to 1 July 2019 – this period had the house on it and was her PPR (9 Years)

The taxation implications are not calculated until you sell the property and as the property was not your PPR for the entire 19 years CGT is applicable on the property.

Under Taxation Determination 2000/14 the capital gains tax is calculated based on the period of ownership.

Original Land Value (50% of $200,000) $100,000

Building cost $300,000

Total Cost $400,000

Sales Price $600,000

Gain $200,000

Capital Gain = Gain x Non PPR period / Period of Ownership

$200,000 x 9 years / 19 years

Capital Gain $94,737

Taxable Capital Gain $47,368

(50% owned for more than 12 months)

Therefore, as with all long term assets, it is important to retain records of the land cost calculation and property development costs.

Subdividing your block sounds like an easy or quick profit-making exercise …

but it’s important to look at the different scenarios and seeing what the tax implications might be for your instance. If you’re considering subdividing your property, talk to us first.