The JobKeeper Payment – the Federal Governments next stimulus package

The Australian Government has recently announced their next major stimulus package to help people and the economy through this period.

In an effort to encourage employers to keep their employees – instead of letting them go and forcing them to apply for unemployment benefits – the Federal Government will now pay employers $1,500 per fortnight (per employee) to be known as the JobKeeper Payment. This payment is equivalent to the amount that the employee would be eligible for under Newstart.

Eligibility for employers

To be eligible to receive the benefit for their employees, employers must be able to demonstrate that:

- their turnover has reduced by 30% or more to a comparative period a year ago (for businesses with a turnover less than $1 Billion); or,

- their turnover has reduced by 50% or more to a comparative period a year ago (for businesses with a turnover more than $1 Billion); and,

- Employees were employed at 1 March 2020.

Note: At the time of this newsletter, we are waiting for information on how the reduction in turnover is calculated and demonstrated.

Eligible employees

- Are currently employed by the employer (includes those stood down and re-employed)

- Were employed at 1 March 2020, (note that the ATO will also have this information from the single touch payroll records)

- Were either full time or casual (casual employees need to be employed on a regular basis for more than 12 months as at 1 March 2020)

- Are Over 16 years of age

- Are not receiving a JobKeeper payment from another employer

What happens if you have let an employee go?

If you have recently let an employee go (for example you are a restaurant owner and have closed) then, as long as they were employed as at 1 March 2020, you can re-employee them and qualify to receive the payment.

Payment amount

For each eligible employees the business will receive an amount of $1,500 per fortnight per employee, commencing 30 March 2020 for 6 months to 30 September 2020. It is anticipated that the first payments will commence in May 2020 and be backdated to 30 March.

The $1,500 is a fixed amount per employee and is not based on their previous income.

Each employee is required to receive at a minimum $1,500 before tax. The employer will still be responsible for paying superannuation and Workcover, hence these may cost employers $150 to $200 per fortnight.

Sole Traders

Business with no employees also qualify and can register for the JobKeeper payment.

They will be required to register with the ATO and provide information to declare their eligibility.

To Apply

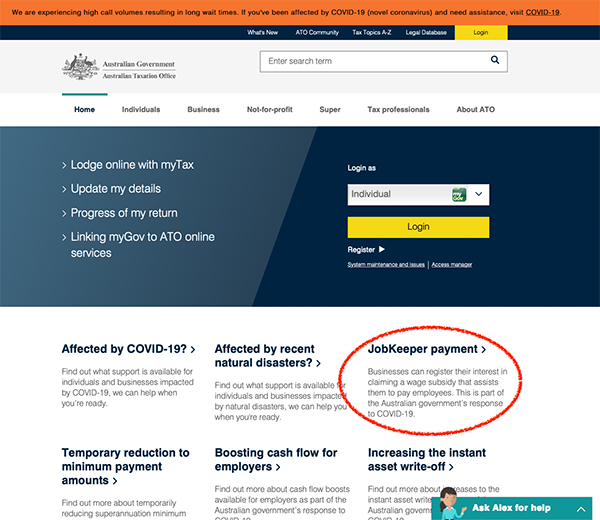

Go to: ato.gov.au and follow the prompts under the heading 'JobKeeper Payment'.

As with most announcements, we are waiting on details of the information that will be required to be provided to meet and claim the JobKeeper payment requirements.

For businesses, this is an excellent opportunity to retain staff to assist with business development projects (like maintenance, procedures, menu updates etc) that helps or improves the business when it re-commences operations in the future.