News

- Vimeo Video ID: 541875834

- Vimeo Video ID: 544844463

- Vimeo Video ID: 551243546

- Vimeo Video ID: 538924449

BK Partners Privacy Policy BK Partners Pty Ltd ABN 49 828 241 780 and any affiliated organisations (collectively referred to in this policy as “BK Partners” is committed to protecting the privacy of your personal information. This privacy policy explains how BK Partners manages the personal inf...

- Vimeo Video ID: 515974337

One of the most frequently asked questions I hear from my business clients is: “What is the difference between an employee and a contractor?”. This question comes generally from those people who are considering taking on someone to do some work for them and whether they should be engaged as an ...

- Vimeo Video ID: 470435421

In previous videos we’ve delved into the three key areas to improving profitability in your business. These three key areas were pointed out to me by my boss nearly 30 years ago and include: Sales, margins and expenses. He explained to me that they should be looked at in that precise order too. If...

- Vimeo Video ID: 467222083

In this article, we look at margins: the second area to improving profitability. Margin is the profit that you’re making on the products you sell. Everyone is selling products; whether that’s time, materials or something else. We’re going to look at the profit you’re making on these items.&...

- Vimeo Video ID: 461602266

When I first started work I asked my boss “how I can help my customers increase their profitability?”. He told me that “there is three key areas to focus on and if you focus on them in order, you will help them.” I have certainly found this to be true. The key areas are, in order: Sales, M...

- Vimeo Video ID: 447003419

This is a very common question and there are two scenarios at play here: Scenario 1. Subdivide, develop and then rent Let’s say we’ve subdivided the land, and built a new house on it with a view to rent that house out. Are there any capital gains tax implications on this? The answer is n...

Read more: Subdivide, develop and then rent or sell … what are the tax implications?

- Vimeo Video ID: 440176312

If you were to sell your property which meets the requirements of being your Principal Place of Residence (PPR) as a whole (i.e. before subdivision), then there would be no taxation implications. But what if you subdivide with the aim of selling off a portion? As we discussed in our article D...

Read more: What if I subdivide my property and sell the vacant land?

- Vimeo Video ID: 440175493

I receive a lot of questions from people who are looking at subdividing their property and want to know if there’s going to be any taxation implications. I’ll take you through a scenario of subdividing the property that features the house you live in initially, building a new house on the...

Read more: Subdiving, building and moving into the new house … what are the tax implications?

- Vimeo Video ID: 437692667

As we enter a new financial year and I prepare financial accounts and tax returns for my business clients, a common comment I receive when reviewing their profit is “I didn’t make that much profit!” followed closely by “If I did … where did the money go?” Like most business owners, you ...

- Vimeo Video ID: 427304034

People sell their rental properties for a variety of reasons. These might include to pay off debt; for retirement savings; the property is too difficult to manage; or, they are looking to invest in other options. When selling a property, we need to consider the capital gains taxation (CGT) implicat...

Read more: Property depreciation and selling a rental property

- Vimeo Video ID: 417011858

With 30 June 2020 less than 6 weeks away, now is the perfect time to review your situation and projected tax commitments to make sure that you take advantage of any planning opportunities and that your financial situation is maximised. The last two months have been very difficult for business. As w...

Read more: Taxation Planning and Understanding Your Commitments

- Vimeo Video ID: 410011713

Following on from our article about Eligible employees, the following information about eligible employers is correct at 20 April, 2020 JobKeeper – Employer Information The JobKeeper Package is an employee subsidy of $1,500 per fortnight for 30 March 2020 – 27 September 2020 (note this period ...

- Vimeo Video ID: 409629625

The ATO is constantly releasing information relating to the JobKeeper package. The following is correct based on the information available as at 20 April, 2020 JobKeeper – Employee Information Can an employee register for JobKeeper on behalf of their employer? No. Employers needs to...

Read more: JobKeeper Information – who are eligible employees?

The ATO is constantly releasing information relating to the JobKeeper package. The following is correct based on the information available as at 20 April, 2020 JobKeeper – Employee Information Can an employee register for JobKeeper on behalf of their employer? No. Employers needs ...

- Vimeo Video ID: 402433286

The Australian Government has recently announced their next major stimulus package to help people and the economy through this period. In an effort to encourage employers to keep their employees – instead of letting them go and forcing them to apply for unemployment benefits – the Federal Gover...

Read more: The JobKeeper Payment – the Federal Governments next stimulus package

- Vimeo Video ID: 400133480

Sunday night (22 March), the Prime Minister announced the second stimulus package to assist businesses and individuals through the Coronavirus period. The following is the taxation related content. Employee PAYG Refund For businesses and certain not-for-profits who employ people and have a tu...

- Vimeo Video ID: 398116956

Note: This legislation is yet to pass parliament – therefore this email has been based on the information that the Government has released to date. That being said, the changes are not complex nor controversial and I would expect them to pass as they are. As a result of the corona virus and t...

Read more: Coronavirus – Government support package for business investment

A major customer has gone broke and you are left with a large amount of money owed to you that you are not able to collect. The resulting cashflow issues that this can create are significant or, even worse, could force you out of business as well. It’s the stuff of nightmares. What’s more...

Retirement isn’t necessarily a permanent thing. Even the best-laid plans can need to be adjusted when circumstances change. The Australian Bureau of Statistics has found the most common reasons retirees return to employment are: financial necessity (ie poor investment returns, financial emerge...

I get a lot of questions from people who want to purchase a property, live in it, do it up and sell it at a for a profit and then repeat the process; aka a property ‘flip’. In previous articles, we have discussed the Main Residence Exemption; to recap: Your ‘main residence’ (your home) is g...

FREEDOM. It’s quite often the number one reason people go into business for themselves. In particular, they are looking for freedom in one or more of three areas: Time Money Mind While most people will say all three are important there is normally one was the key motivator for why they wen...

Read more: How remembering your ‘why’ can help you plan for a new year

Building wealth through owning property is a very common strategy to create long term wealth. According to the ATO there are nearly 2 million individuals that own an investment property; that’s a significant number of people! While the ATO produces an excellent guide for rental properties (you c...

In part 1 of 7 Ways to Grow Your Business and Profitability, I covered the first 3 ways: No. 1: Build customer retention No. 2: Generate more leads No. 3: Increase conversion rate I hope that you have taken some time to review your business to see how the above areas could assist you. Now, on t...

Read more: 7 Ways to Grow Your Business and Profitability – Part 2

The Challenge Sustaining and growing a business is a challenge. Business conditions change, new competition pops-up, your customers’ wants change. Technology changes, regulations change, finance conditions vary, customers delay in making decisions … the list goes on. Despite what we might thi...

There’s been a lot of reports in the news lately about businesses going broke and the effect that this has on the business owner, suppliers, subcontractors and others … sometimes devastating. Sadly, many times families lose everything, often having to start again due to no fault of their own. ...

A family (or discretionary) trust can be a good way to hold assets to protect them from claims that are made against you or your business … so why not put your house in a trust? We have heard of stories of businesses that have gone under leaving creditors, suppliers and subcontractors out of pock...

A real example and ATO audit outcome. Most businesses reach a point at which they need an extra pair of hands. This could be on either a short term or long-term basis. Hiring someone as a ‘contractor’ sounds like a simple and cost-effective solution: payment on invoice, no calculating tax, with...

In this, the third article in our series ‘Divide and Conquer’, we’ll look at the next scenario: Building to live in. If you haven’t read our first two articles, then I highly recommend that you do before diving into this one. Divide and Conquer Divide and Conquer … Tax implications of sub...

A common discussion around the dinner table with our kids is ‘who is the favourite child?’. We have three teenagers so the debating is intense about the virtues they all possess and why they should be named as the favourite. One night, about two years ago when the debate was memorably strong, t...

In our last article – Divide and Conquer … Tax implications of subdividing your property – we just scratched the surface of the tax implications of subdividing your property. If you haven’t read it, then I recommend you do before continuing. In this article I would like to explore two scena...

Read more: Divide and Conquer 2: Tax implications of subdividing your property

The ‘quarter-acre block’ may have been the great Aussie dream post World War II, but for many, this amount of land it too much to handle. The opportunity to subdivide and selling in order to pay down debt or fund other plans is therefore an attractive strategy to those burdened with too much lan...

Read more: Divide and conquer … Tax implications of subdividing your property

Congratulations! You made it through another financial year. I’m not sure how you feel, but I think they seem to go quicker each year. For many the new financial year will be a case of “same old, same old” … same old business methods, same old profit (or lack thereof), same old business...

Read more: Happy New (Financial) Year! 4 questions to ask to help make it your best yet.

One of the things I enjoy is running. In the past few years have taken up trail running and doing ultra-marathons (runs over 42.2km). Yes, my wife thinks that I am mad and there have been times that I also questioned my own sanity; both when entering and on the run itself. Having grown up in cou...

The ATO recently increased the instant asset write off to $30,000 for eligible assets purchased from 2 April 2019. But does this mean that you should rush out prior to 30 June 2019 and spend up to get a tax deduction? Before spending your money … or borrowing to spend money … there are a few ...

With the end of the financial year only weeks away, it’s a perfect time to review your situation, take advantage of any opportunities and ensure that your financial situation is maximised. Any successful tax planning strategy centres around three themes: 1. reducing income, 2. increasing dedu...

Read more: 30 June is approaching! Do you want to minimise your tax?

A wise man once said: “… in this world nothing can be said to be certain, except death and taxes.” Benjamin Franklin, 1789 People can manage to avoid taxes, however death proves a lot harder to avoid and, sadly, catches up with everyone. While Australia doesn’t have an inheritance ta...

Investing in property though a self-managed super fund (SMSF) is a hot topic in the media and in discussions around the BBQ with friends. SMSF’s are able to borrow and, just like you, can also borrow money in order to purchase a property. We’ve discussed how investing in property is an effectiv...

Read more: Buying a property through a Self Managed Superannuation Fund

The ATO has introduced changes for people selling property that may impact you if you sell a property that you have lived in, an investment property or a property development that you built to sell. Selling your house (Principal place of residence) If you’re selling your property, and it has a s...

Read more: Selling a property, even your house – taxes may apply

As some of you know, I recently took a three week holiday in Vietnam – the first holiday in eight years that I have been away from the office for more than 1 week. Unfortunately, a lack of long holidays is an all too common occurrence amongst business owners. In 2015 Xero undertook a survey o...

Property investment has been a fantastic tool that many of my clients have used to build their wealth where the actual cost of owning a rental property – particularly with low interest rates available – is very affordable, yet the question of if it’s affordable for ‘me’ is one of the most ...

Read more: How much does it REALLY cost to own a rental property and is it for ME?

If you owe money to the ATO, this currently doesn’t appear on credit checks and hence won’t affect your ability to get finance. BUT this is about to change! What is changing The Government has announced that it will allow the Australian Taxation Office (ATO) to disclose tax debt information of...

With the end of the financial year only 2 weeks away it is perfect time to review your situation to take advantage of any planning opportunities and ensure that your financial situation is maximised. Any successful tax planning strategy centres around three themes: reducing income, increasing d...

Television and news feeds were flooded with the proposed personal income tax cuts after the May 8 Federal Budget announcement, but there were a number of other measures included that received little mention that are important, and equally worth highlighting. First, let’s talk about th...

Read more: 2018 Federal Budget – the bits you might have missed

The ATO has recently been in the news and featured on Channel 9’s A Current Affairarticle ‘Tax Grab Scandal’ for the ‘unfair actions they were taking against 3 businesses. Here’s my take on the ‘scandals’ and the lessons we can learn from these cases from t...

Read more: The big ‘ATO Tax Grab Scandal’ — 4 take away lessons

Legislation is now in place from the May 2017 Budget where the Government announced a raft of proposals it hoped would relieve the pressure on residential property prices. Two of these measures are targeted at reducing the income tax deductions passive investors in rental residential properties can ...

Read more: The who, what and how of changes to deductions for residential rental properties.

Many people invest in property as a way of building wealth and, like all assets, there often comes a time when they need to be sold. And selling assets can cost you in the form of TAX! If you have lived in your own home – or principal place of residence (PPR) – for the entire time...

“Where did the profit go?” I hear it almost every day from the businesses I work with. Followed quickly by: “How did I make that much?” and “Why isn’t there more in the bank account?” You, like most business owners, are used to working hard and are good w...

Many businesses suffer the problem of tight cashflow in the post-Christmas period. It’s not only the expense of the festive season; people are away, customers are recovering from holidays, and work can’t be completed. If you plan correctly now, there is no need to suffer from tight cashflow. T...

With the end of financial year fast approaching, starting to prepare now will save time and headaches when the June 30 deadline arrives. There are a few common financial planning strategies that may be appropriate for businesses and individuals looking to take control of their finances and plan for...

Teaming up with another business can be an effective way to maximise efficencies and profits, but joint ventures need to be understood, managed carefully and documented well to avoid major pitfalls and legal problems. Attachments: Joint Ventures[ ]1124 kB ...

-

Upload PDF for Email:

Business Income and Expenses Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2016/17 compared to 2015/16. Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is rece...

-

Upload PDF for Email:

The ATO is targeting those who rent out their property for a few weeks during the year but claim a full year’s worth of tax deductions. The tax office will be paying close attention to rental property owners, especially those who own a holiday home, who incorrectly claim for initial repairs t...

It is an unfortunate fact of business life that sometimes you will not be paid in full for work you have done. When this happens you have incurred a bad debt, and it is a very frustrating experience. The silver lining to this situation is that there are some tax breaks that can come along with a ba...

As personal technology devices such as laptops, smartphones and tablets, are becoming increasingly prevalent, the ATO will be focusing its attention on individuals claiming tech items as work-related tax deductions. Currently, Australians claim almost $19.5 billion each year in work-related expense...

Once again it is year end and businesses in the building and construction industry need to report the total payments they make to each contractor for building and construction services each year. Background As part of the 2011-12 Federal Budget, the government announced the introduction of taxable...

Did you know that your Ute, or Van may be subject to Fringe Benefits Tax? Firstly what is Fringe Benefits Tax (“FBT”) FBT is a tax that is payable on certain benefits that you either give or pay your employees and associates (ie wife or partner). This encompasses many things but today I am j...

It is important that you take the time to focus on tax planning and the tax issues that affect you before 30 June 2014 arrives. Significant tax and cashflow savings can be created by a number of general tax planning strategies. Business Income and Expenses Subject to cash flow requirements, ...

A new dependant tax offset allows individuals to claim an offset for invalids and carers. At the start of the 2012-13 financial year, the ATO made some changes to how individuals can claim offsets for dependants when lodging a tax return. One change is the eligibility age for the dependant tax...

In our last newsletter, we visited the issue of protecting your assets and started to discuss some of the ‘ownership’ options such as companies or trusts. Many businesses operate via a company. Some people with large amounts of business assets even use a separate company (or...

Testamentary Trusts can be incorporated into a Will to provide greater flexibility for the beneficiaries of a deceased estate. A Testamentary Trust operates under a Trust structure whereby assets are managed by one person or persons, such as a trustee, for the benefits of others, known as benefic...

An area that I am commonly asked about is about what are the taxation implications of developing a property? Given the significant value of the transaction it is a very good question as the taxation implications can have a dramatic impact on the profitability of the project. Property investor...

Read more: What is the tax difference between a Property Developer and an Investor?

With 30 June 2013 only 3 weeks away it is perfect time to review your situation to make sure that you take advantage of any planning opportunities to ensure that your financial situation is maximised. Document and claim all work-related expenses, you can automatically write off $300 a year ...

It is important that you take the time to focus on tax planning and the tax issues that affect you before 30 June 2013 arrives. Significant tax and cashflow savings can be created by a number of general tax planning strategies. Business Income and Expenses Subject to cash flow requirements...

With year-end fast approaching and people consider contributing funds into superannuation it is important to consider the changes that have been proposed in the 2016 budget. Whist the changes are only proposed and subject to amendment it is important that you consider them as there is little polit...

Pre-budget speculation around changes to Australia’s current superannuation rules and tax concessions may be a cause for concern among some taxpayers. However, there are ways to best position yourself now for any potential changes to the superannuation system. Here are three options for indi...

Self-managed superannuation fund (SMSF) trustees should be aware of the new rules for holding investments in collectables and personal use assets that come into full effect on 1 July 2016. The new rules that were introduced 1 July 2011 have amendments to the guidelines for storage, insurance and va...

Employers must be able to differentiate between an employee or a contractor in order to meet their superannuation obligations. While employees work as a part of a business, contractors provide services to a business through their own business. Employers that fail to acknowledge this difference risk...

Read more: Superannuation obligations: employees vs contractors

One of the most exciting things about starting a self-managed superannuation fund (SMSF) is the possibility of buying property. Property that you purchase in your SMSF can be transferred to you once you reach retirement age or retained in the SMSF where any income it generates will remain tax-free....

1. What is a Self Managed Super Fund? A self-managed super fund (SMSF) is a superannuation fund with a maximum of four members who act as the fund's trustees and direct its investment strategy, giving Australians the chance to take a more active role in planning their retirement. SMSFs represe...

Read more: 7 Things you need to know about Self Managed Super Funds

The government has announced that it will freeze the superannuation guarantee at 9.5% until 2021. Under previous plans, the super contributions paid by employers had been set to increase in 0.5% increments from the current rate of 9.5% until they reached 12% in 2019/2020. It will now be 2025 b...

By investing in fully franked Australian shares, SMSF (Self Managed Superannuation Fund) trustees can significantly reduce the amount of tax payable by their fund. This is because these shares are issued with a franking credit, also known as an imputation credit, which can be used to offset the tax...

As detailed in our May 2013 newsletter the super guarantee (SG) rate increases to 12% over seven years, as shown in the table below. 1 July 2003 - 30 June 2013 9% 1 July 2013 - 30 June 2014 9.25% 1 July 2014 - 30 June 2015 9.5% 1 July 2015 - 30 June 2016 10% 1 Ju...

I was recently asked by one of my clients if they could purchase a car in their Self-Managed Superannuation Fund (SMSF). Trustees of SMSF’s are aware whilst the ATO does not prohibit a SMSF investing in collectables and artwork, they may be less sure of the rules concerning cars and motorcycle...

Read more: Motor vehicles as Self-Managed Superannuation Fund assets

To help grow Australian workers' savings for retirement, the compulsory super guarantee rate will gradually increase from 9% to 12%. When you make super payments on behalf of your employees based on the minimum 9% super guarantee rate, you will need to increase this rate on which you bas...

When renovating an investment property, it is important to keep in mind the taxation deductions available such as depreciation and capital works deductions. Investors seeking to renovate property that is used for income-producing purposes need to be aware of the tax-deductible expenses that can be ...

The ATO has increased their data matching for rental property owners who are claiming tax deductions in their income tax returns. In April, the ATO revealed it would use new data-matching technology to closely scrutinise residential and commercial property sales to ensure tax payers paid the correc...

As a business owner, there are plenty of things you need to manage, and two of the most important of these are risk and assets. In other words, building your wealth and protecting your wealth. There’s no point building a lot of wealth if the way you have things structured behind the scenes means...

Read more: Business Owners: Are You Inadvertently Putting Your Family Home At Risk?

Can I buy my office or warehouse with my superannuation money? Attachments: Buying Property With Super[ ]117 kB ...

The seventh strategy in this business growth series is about “margin”. In the previous articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process Making things Flow...

The sixth strategy in this business growth series is all about “margin”. In the previous four articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process Making thin...

The fifth strategy in business growth is about the ‘flow of your business’. In the previous four articles of this series we covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process In th...

On the 6th of May I will be conducting a seminar with the Inner West Business Enterprise Centre to help setup businesses with Quickbooks Online. The seminar will be very practical with the goal for participants to leave with the cloud based accounting software, Quickbooks Online, up and running wit...

The fourth strategy is generally about the overall effectiveness of your business. In the previous 3 articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value The overall effectiveness of your business is ...

As people get older they need to make arrangements on how to handle their estate, and their personal interests in the event of sickness or death. Contrary to popular belief, an individual’s parents, spouse or significant other are not always automatically empowered to make these decisions on thei...

You may recall we have already discussed the first two strategies to grow a business; ‘increase customers or clients’ and ‘increase the transaction frequency’. Let’s explore the next strategy: Increase the transaction value. This strategy is often referred to as t...

In the last article we looked at the strategy of finding new customers. The next strategy for increasing sales or income in your business is to increase the transaction frequency with your customers. Some experts believe that the most important strategy for business growth is to increase the s...

You may recall in my last newsletter the concept of only needing to focus on ‘three’ areas to help grow a business and improve its profitability. Many business development books and consultants argue there are numerous aspects to consider. However, if you think of any business strategy y...

Many small business owners fall into the trap of building a business entirely dependent on them so that it would not survive if they were unable to work. They have not built a business rather, they've created themselves a job. Even worse a job from which they can’t resign or take extende...

What are the differences between a person being an employee or a contractor? Many business owners ask me this question. This article should help clarify some of your concerns. It is important that you understand the differences as a number of government organisations are continually reviewing the...

A comment that I frequently hear when reviewing a person’s accounts and taxation returns is “… that can’t be right, we don’t have any money … where has all the cash gone if we made that much profit …” Sound familiar? So, where did the money go? Firstly we need to look at the...

Planning on buying equipment? If you plan to purchase a depreciating asset (e.g. computers, machinery, cars), here’s what you can claim before 30 June. On 1 July 2002 the Australian Taxation Office (ATO) introduced new depreciation rules. The changes significantly increased the amount a bus...

A successful business is simply defined as one that achieves the objectives of the business owner.

SuperStream kick-starts on 1 July 2015 for businesses with less than 20 employees and you have until 30 June 2016 to meet the SuperStream requirements. The new reform simplifies employer superannuation contributions by requiring all businesses to make payments electronically to all funds. Small bus...

In the budget on 12 May 2015, the treasurer announced that small business will be able to immediately claim a tax deduction for assets costing less than $20,000 as opposed to currently being able to write off assets costing less than $1,000. What does this actually mean for you? Is this law y...

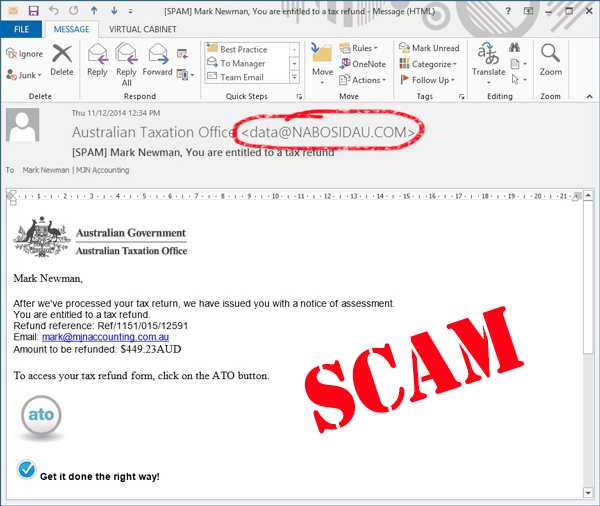

Good news everyone I am getting a tax refund! But wait … I haven’t lodged my tax return and I actually have to pay tax this year! Over the past few months I have received quite a few questions from people who have received emails from the ATO advising them they are entitled to a refund, I have ...

As of July 1 2014, there have been some changes to the concessional superannuation contributions cap, which is welcome news to the over 55's. The higher $35,000 concessional superannuation contributions cap, which was previously only available to people over the age of sixty, has now been extended ...

Read more: Make the most of transitioning to retirement — Important for people 55 and over.

It is common for businesses to make GST errors in their BAS. The majority of these mistakes are unintentional. The ATO recently reviewed all of the BAS adjustments made as a result of auditing and revealed that over 80% were the result of inadvertent GST mistakes. Examples of common mistakes inclu...

The ATO has recently released an app to help individuals and small business owners. You can use the new ATO app to: determine if your worker is an employee or contractor for tax and superannuation purposes search Small business assist to find relevant information and YouTube video explana...

On Friday 28 February 2014 we will be moving approximately 400 metres north to Suite 4, 154 Fullarton Road, Rose Park. The 2013 year was an excellent year at BK Partners. Many clients referred their friends and business associates to us to support them with their business and accounting needs...