Others

SuperStream kick-starts on 1 July 2015 for businesses with less than 20 employees and you have until 30 June 2016 to meet the SuperStream requirements. The new reform simplifies employer superannuation contributions by requiring all businesses to make payments electronically to all funds. Small bus...

In the budget on 12 May 2015, the treasurer announced that small business will be able to immediately claim a tax deduction for assets costing less than $20,000 as opposed to currently being able to write off assets costing less than $1,000. What does this actually mean for you? Is this law y...

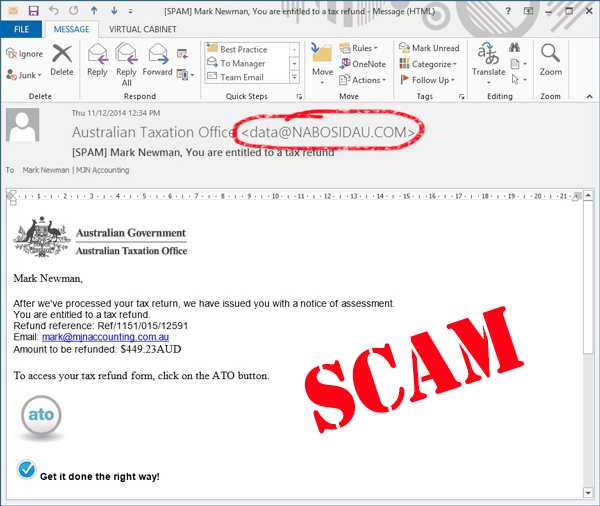

Good news everyone I am getting a tax refund! But wait … I haven’t lodged my tax return and I actually have to pay tax this year! Over the past few months I have received quite a few questions from people who have received emails from the ATO advising them they are entitled to a refund, I have ...

As of July 1 2014, there have been some changes to the concessional superannuation contributions cap, which is welcome news to the over 55's. The higher $35,000 concessional superannuation contributions cap, which was previously only available to people over the age of sixty, has now been extended ...

Read more: Make the most of transitioning to retirement — Important for people 55 and over.

It is common for businesses to make GST errors in their BAS. The majority of these mistakes are unintentional. The ATO recently reviewed all of the BAS adjustments made as a result of auditing and revealed that over 80% were the result of inadvertent GST mistakes. Examples of common mistakes inclu...

The ATO has recently released an app to help individuals and small business owners. You can use the new ATO app to: determine if your worker is an employee or contractor for tax and superannuation purposes search Small business assist to find relevant information and YouTube video explana...

On Friday 28 February 2014 we will be moving approximately 400 metres north to Suite 4, 154 Fullarton Road, Rose Park. The 2013 year was an excellent year at BK Partners. Many clients referred their friends and business associates to us to support them with their business and accounting needs...

Most industry super funds offer members a basic level of personal insurance cover. Holding your insurance within super, rather than having stand alone policies (policies you pay for personally), can have its benefits. In a stand-alone policy you would typically pay premiums from after-tax earnings. ...

Read more: Paying for your insurance, should you use your superfund?

You have probably heard this term in the medial lately, therefore I have added this article to provide you with a background of what they are referring to. The Federal Government has introduced changes to the superannuation system designed to make Australia’s superannuation system stronger and mo...

The new Federal Government's plan to remove the Mineral Resource Rent Tax (The MRRT), also involves removing some tax benefits that are currently available to small businesses. Whilst the Federal Government had made this known in their commentary in the past, it is now Draft Legislation. In r...

As you all know I am a big supporter of the online accounting program Xero (www.xero.com.au) due to its simplicity of use, ability to access from any location, no data backups required, etc. Most importantly I can work with you in a more timely manner by being able to view the same data and inform...

In our past couple of editions we have discussed some foundation asset protection strategies and explored some of the misconceptions regarding various matters. We have also highlighted the need to obtain specific advice for your own situation before a problem arises. But, what if you are now faced ...

The Australian Taxation Office (ATO) now has a greater ability to make company directors accountable for unpaid PAYG withholding and superannuation guarantee obligations of their company. These changes are intended to discourage directors from being involved in fraudulent phoenix activity. The chan...

This is the first in a series of articles looking at how you can protect your hard earned assets; your home, your business and/or your investments. Like all financial matters, you must have a strategy. Unfortunately for many their asset protection strategy stops with insurance believing this will c...

We have been working with Roxby and other remote area workers for over 20 years and during this time have been asked a lot of questions about zone rebate. History The Zone rebate was introduced in 1945 to recognise the disadvantages that people in remote areas encounter. For example the high...

There are now greater penalties in place for breaches of most Australian tax laws. The ATO has increased the value of a penalty unit from $110 to $170, the first such increase since 1997. A maximum of 5 penalty units for a very late tax return increases $300 to $850 ($170 x 5) from the previous $55...

You probably have now all heard of cloud computing, but how can it help you with your bookkeeping and accounting? Presently the accounting software industry is going through one of the greatest changes that I have seen in 20 years since MYOB, Quickbooks and other desktop computer programs were intr...

Read more: Why change your accounting system to a cloud based system.

Image source www.dfat.gov.au Significant changes that will impact on individuals. Increased Medicare levy The big news item is a 0.5 per cent increase in the Medicare levy to fund the National Disability Insurance Scheme. Under the proposal, the levy will increase from 1.5 per cent to 2 per cen...

The ATO is introducing a system where from 1 July 2012 you will be required to record and report to the ATO all subcontractor payments in the building industry. Attachments: ATO Reporting for Builders[ ]472 kB ...